- 已编辑

When they first entered the industry, I believe many practitioners have been discouraged by various layer after layer fees in cross-border industries. They found that reducing costs is often more practical and effective when they try to improve profits. After calculating various costs, don’t forget that there may be the last step of collecting charges - Facebook taxes. Pay attention to avoid pitfalls.

When the author bought a batch of new Facebook non-US dollar accounts a few days ago, he had made a good psychological expectation of paying tax. Most of the accounts we encounter have taxes to be paid, having a tax rate of 5% - 8%, which is an acceptable range. When we run, we can’t bear to throw them away, and we can continue to use them when we have profits.

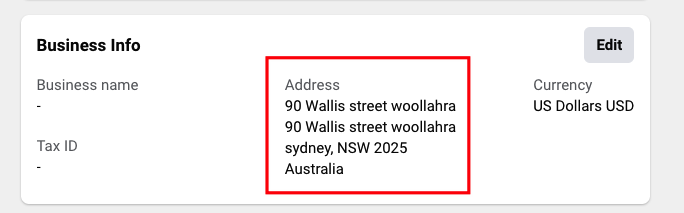

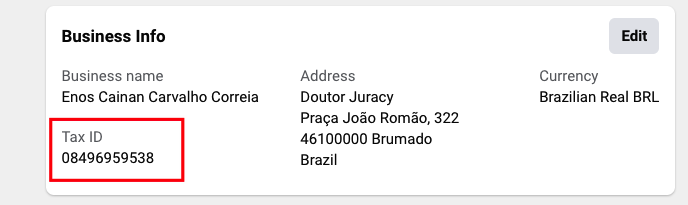

The tax rate is subject to the country/region of the advertising account and has little to do with the currency.

Some countries do not need to pay tax when filling in Tax ID, but it is recommended to choose the number corresponding to the country and currency.

Regarding which specific regions need to pay what kind of tax, how much tax rate, and the frequent changes, will not be listed here. Please refer to the official advertising policy of Facebook:

https://www.facebook.com/business/help/133076073434794

Therefore, it is recommended that you check the details of the bill more. Once you find that the actual cost of each bill is much higher than the deduction amount of the bill, you can consider shutting down the advertisement and cutting your losses.

Click on the link to view the Chinese version:

https://veryfb.com/d/107-fb